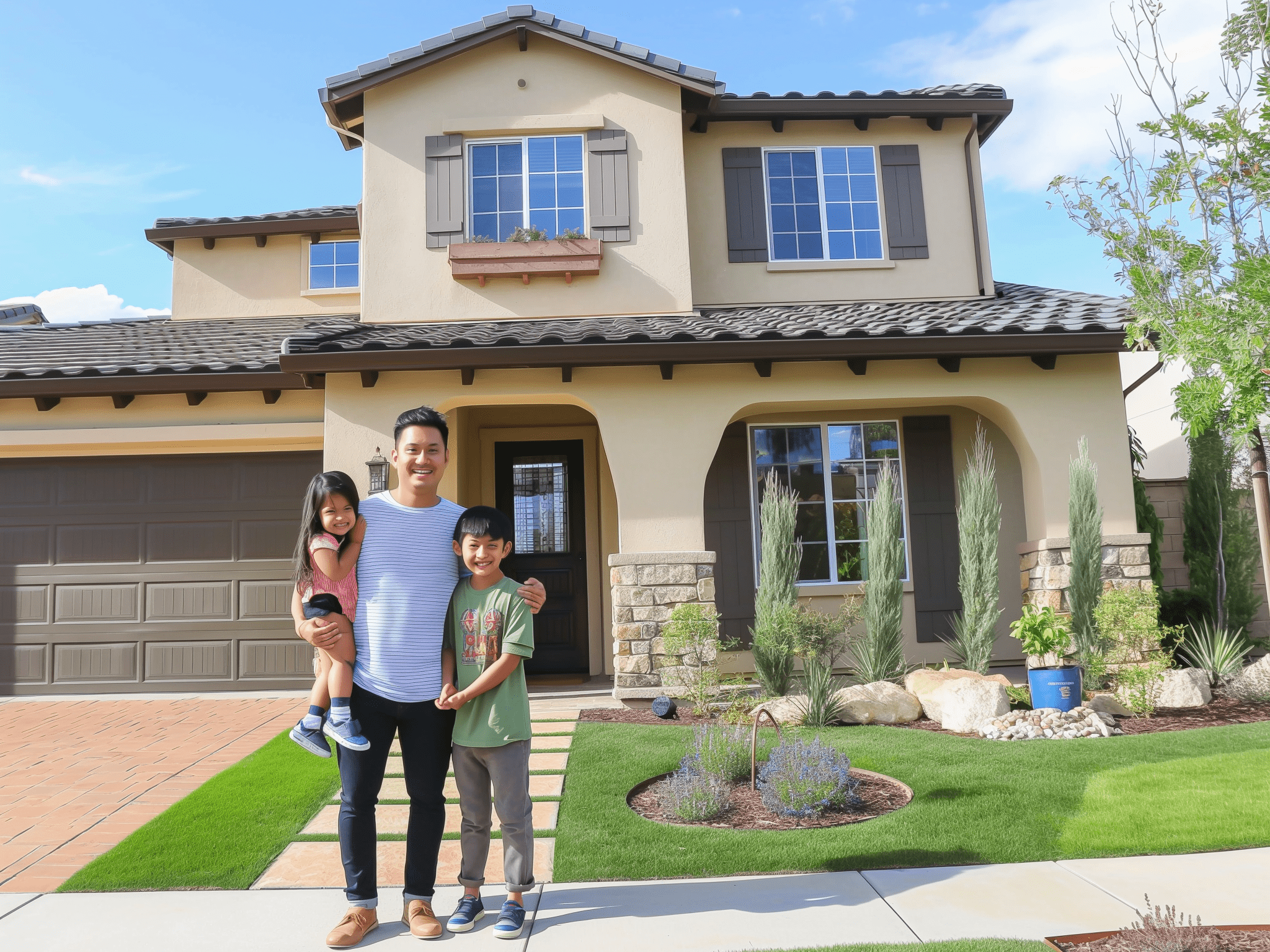

Making Mortgages Easier in Temecula

Navigate your Temecula home buying mortgage journey with a trusted local Temecula mortgage lender.

Your Trusted Partner in Home Buying

At Temecula Mortgage, we’re committed to making the mortgage process approachable and stress-free. Our team of experts is here to guide you every step of the way.

Personalized Service

We take the time to understand your unique needs and goals to find the perfect mortgage solution for you.

Transparent Process

We believe in clear communication and keeping you informed at every stage of the mortgage journey.

Local Expertise

As Temecula locals, we have in-depth knowledge of the local housing market and can help you navigate it with confidence.

Advanced Tools

Our suite of calculators and resources empower you to make informed decisions about your mortgage.

Diverse Loan Options

Whether you’re a first-time buyer or a seasoned investor, we offer a wide range of loan products to fit your needs.

Ongoing Support

Our relationship doesn’t end at closing. We’re here to support you throughout the life of your loan.

All the Tools You Need, All in One Place

We’ve developed a suite of resources to help you navigate the mortgage process with ease and confidence. As leading Temecula mortgage lenders, we’re committed to your success.

Temecula Mortgage Calculators

- Estimate your monthly payments.

- See how much home you can afford.

- Compare different loan scenarios.

Temecula Mortgage Learning Center

- In-depth articles on mortgage topic

- Guides for first-time home buyers

- Answers to frequently asked questions.